UK inflation: How does the UK compare with other economies?

- by Admin

- May 22, 2024

Reuters

ReutersOn the day that Rishi Sunak called a July election and the latest figures showed inflation falling, the government has been talking about its record on the economy.

Chancellor Jeremy Hunt made a number of claims on BBC Radio 4 on Wednesday, including comparisons between the UK economy and other countries.

We have looked at some of them.

Inflation

Mr Hunt said: “Inflation [in the UK] is now lower than in the eurozone or in the United States of America, but prices are still a lot higher than they were a year ago.”

He’s right. Inflation measured by the Consumer Prices Index (CPI) was 2.3% in the UK in the year to April 2024.

The main measure of consumer inflation in the US in April 2024 was 3.4%. And in the eurozone, inflation in April was 2.4%.

But the UK’s inflation rate peaked higher than in the US and the eurozone, at 11.1% in October 2022.

Growth

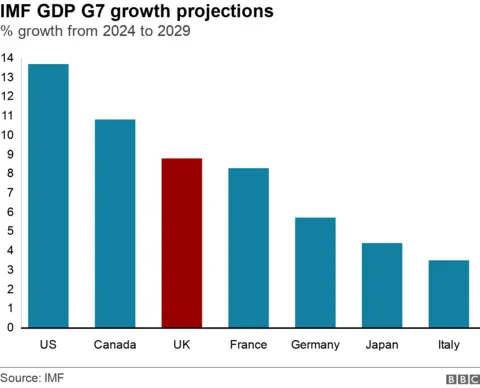

Mr Hunt said that “the UK economy will grow faster over the next six years than in France, Germany, Italy or Japan”, according to the International Monetary Fund (IMF).

It should be said that forecasting what the economy will be like six years in the future is highly uncertain.

The IMF did indeed predict that the UK economy, as measured through its gross domestic product (GDP), would be 8.8% bigger by the end of 2029 than at the start of this year.

That would be more growth than it forecasts for France (8.3%), Germany (5.7%), Italy (3.5%) or Japan (4.4%).

But it would be smaller than the other two members of the G7 major advanced economies: US (13.7%) and Canada (10.8%).

It should also be mentioned that other forecasters are less optimistic about the UK, at least in the short term.

The Organisation for Economic Co-operation and Development (OECD), for example, predicts that the UK will have the worst growth in the G7 next year. The OECD is a group of countries which aims to assist economic development, raise living standards and promote growth in world trade.

Living standards

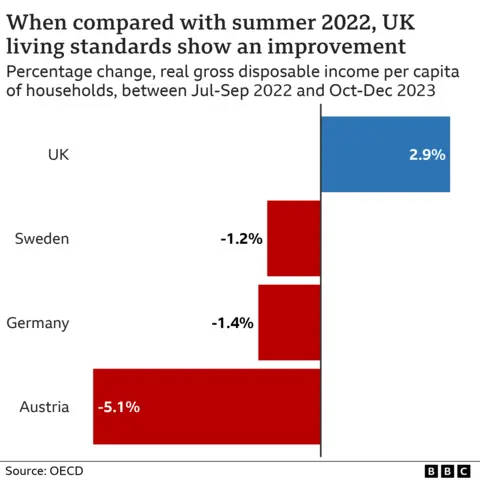

Talking about what has happened to living standards in the UK, Mr Hunt said: “Living standards have fallen by more in Germany, Austria or Sweden.”

The chancellor did not specify which measure of living standards he was talking about, or over what period.

BBC Verify could not find the figures to support his claim, so we asked the Treasury.

It told us Mr Hunt was talking about the OECD’s measure of “gross disposable household income” over a specific period – comparing July to September 2022 with October to December 2023.

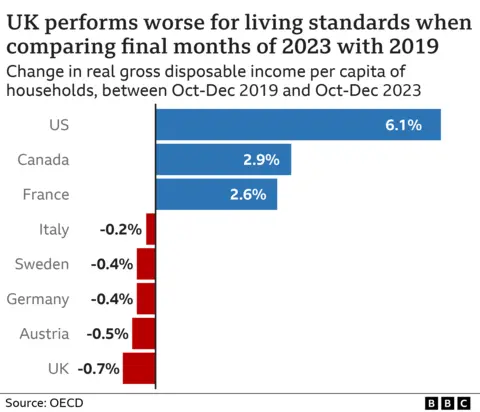

This is borne out by the OECD data, although the choice of time period seems arbitrary, as does the selection of comparator countries.

If you look at UK living standards between the last three months of 2019 – before the pandemic started – and the end of last year, they have performed worse than those countries and also worse than the G7 average.

The G7 (Group of Seven) is a group of seven big industrialised economies.

Investment

“We’ve attracted more than that [foreign direct investment] then anywhere in the world except the United States and China since 2010,” Mr Hunt said.

The Department for Business and Trade produces an overview of “greenfield foreign direct investment data”.

“Greenfield” refers to the entire new investment in a country.

This data shows that foreign investment in the UK grew by £498bn between 2010 and 2022. That’s lower than the US (£848bn) and China (£708bn), but higher than Germany (£222bn) and France (£133bn)

Another indicator of relative attractiveness of European countries to foreign investors by the accountancy firm EY suggests the UK has fallen behind France.

World Bank data on foreign direct investment as a share of the economy suggests that the difference between France, Germany and the UK is less pronounced than the greenfield data.

Additional reporting by Gerry Georgieva

The Latest News

-

December 22, 2024Life in one of Britain’s most miserable towns: Locals in Barking blast council ‘shambles’ and say shopping centre is so empty it is like living in a ‘ghost town’

-

December 22, 2024Christmas travel chaos continues with 100 Heathrow flights cancelled amid severe 80mph wind weather warnings

-

December 22, 2024Winds blow UK Christmas travel off course, with ferries and flights cancelled

-

December 22, 2024What next for Tyson Fury and Oleksandr Usyk? | Will Fury face Anthony Joshua and could Usyk retire?

-

December 22, 2024Let China build electric cars in UK, Tory ex-chancellor tells Rachel Reeves ahead of trade trip