UK now aiming for SMR and Sizewell C decisions in spring 2025

- by Admin

- October 31, 2024

Key decisions on which small modular reactor technologies to select and on a Final Investment Decision on Sizewell C will be taken in spring 2025, according to timelines set out in the government’s Budget documents.

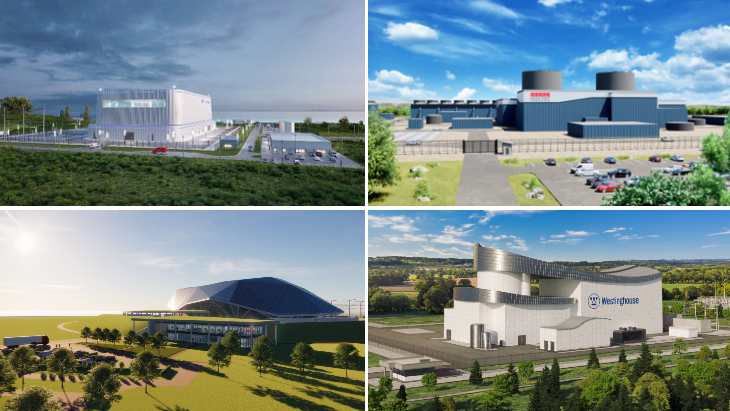

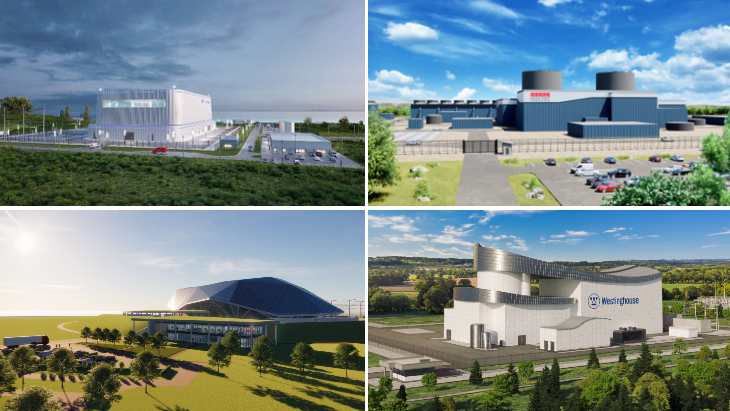

There are currently four technology providers on the final shortlist for the UK’s small modular reactor (SMR) selection process, which is expected to see two of them being chosen to receive government backing to roll out multiple units at a selected site. The four are GE-Hitachi, Holtec Britain, Rolls-Royce SMR and Westinghouse Electric Company.

The aim had been for the selection process to be concluded this year, but the Labour Government’s first Budget since taking office in July said “final decisions will be taken in the spring”. Great British Nuclear (GBN), the arms-length body running the process, added that it had issued an Invitation to Negotiate to the four companies, “after which they will be invited to submit Final Tenders, which GBN will then evaluate”.

Gwen Parry Jones, CEO of Great British Nuclear, said: “Our SMR selection is on track to provide Britain with new nuclear power in the next decade and beyond. We look forward to completing this complex and groundbreaking procurement over the coming months.”

Meanwhile, a separate commercial pipeline document for GBN was published earlier this week, suggesting that the procurement of a project delivery partner for each SMR technology provider selected would be for an “estimated contract value” over 10 years of GBP600 million-GBP800 million (USD778 million-USD1.04 billion). It lists an estimated procurement start date in 2025 and a contract start date of September 2026. It estimates that a separate GBP200 million contract for “Balance of Plant – Manufacture, supply, installation” would see procurement starting in 2028 and the contract commencing in 2030.

Tom Greatrex, CEO of the UK’s Nuclear Industry Association, said: “Whilst it’s good to see the UK SMR competition reach this stage, what is critical is reaching a decision as soon as possible without any further delays to the now published timeline. Confidence in the UK government’s pronouncements on support for SMRs rests on fulfilling commitments made today. It is vital for supply chain confidence as well as driving the wider nuclear ambition. The government should empower Great British Nuclear to buy more sites, starting with Heysham, so we can deliver a fleet of SMRs for clean, reliable, British power and good, skilled jobs.”

Sizewell C

The UK has plans to increase its nuclear energy capacity to 24 GW by 2050. As well as SMRs there are also ambitious aims for new gigascale plants – the first of which is under construction at Hinkley Point C. A replica of that two EPR unit scheme is being planned at Sizewell C.

In the Budget, which is when the UK government sets out its tax plans and outlines many spending priorities, it gave an update on the Sizewell C project, saying: “New nuclear will play an important role in helping the UK achieve energy security and clean power while securing thousands of good, skilled jobs. The settlement provides GBP2.7 billion of funding to continue Sizewell C’s development through 2025-26. The process to raise equity and debt for the project will shortly move to its final stages and will conclude in the Spring. As with other major multi-year commitments, a Final Investment Decision on whether to proceed with the project will be taken in Phase 2 of the Spending Review.”

It was announced in September that the Department for Energy Security and Net Zero’s Sizewell C Development Expenditure (Devex) Scheme would benefit from up to GBP5.5 billion of subsidies to get to a Final Investment Decision with support granted under the scheme mainly comprised of equity injections by the UK government.

The EDF-led plan is for Sizewell C to feature two EPRs producing 3.2 GW of electricity, enough to power the equivalent of around six million homes for at least 60 years. It would be a similar design to the two-unit plant being built at Hinkley Point C in Somerset, with the aim of building it more quickly and at lower cost as a result of the experience gained from what is the first new nuclear construction project in the UK for about three decades.

The UK government has been seeking investment in the Sizewell C project, launching a pre-qualification for potential investors as the first stage of an equity raise process last September. It has also taken legislation through Parliament allowing a new way of funding new large infrastructure projects – a Regulated Asset Base (RAB) funding model, which can see consumers contributing towards the cost of new nuclear power plants during the construction phase. Under the previous Contracts for Difference system developers finance the construction of a nuclear project and only begin receiving revenue when the station starts generating electricity.

The Latest News

-

December 23, 2024Daily horoscope: December 23, 2024 astrological predictions for your star sign

-

December 23, 2024Sharp fall in UK business activity forecast as economic gloom deepens

-

December 22, 2024Foxtel offloaded to UK streamer for $3.5b

-

December 22, 2024Elon Musk’s British cousin reveals how brutally world’s richest man snubbed him: ‘I’m shocked that…’

-

December 22, 2024‘Labour will torpedo my firm’: One of Britain’s OLDEST family businesses says inheritance tax plans could destroy his finances in ‘blink of an eye’ after 250 years of trading